Light vehicles - control of the correctness of the payment of highway tolls before July 1, 2023

October 13, 2023

#recommended

Control of the correctness of payment of the toll for using a motorway is carried out pursuant to the provisions of the Act of 27 October 1994 on toll motorways and the National Road Fund.

Who is liable to pay the toll and the additional charge

The owner of the vehicle, the holder of the vehicle, or the user of the vehicle is obliged to pay the motorway toll, and an additional fee of PLN 500 is charged for failure to do so.

The lessor entered into the CEPiK, and not the lessee who committed the breach, is responsible for the unpaid motorway trip of a leased car.

Entrepreneurs operating a car rental company, in order to avoid additional costs for not paying tolls on toll road sections in Poland generated by their customers, can register in the e-TOLL system and equip each vehicle with an e-TOLL data communication device: OBU or ZSL. For information on how to register in e-TOLL, please see Registration in e-TOLL.

How control is implemented

Officers of the Customs and Tax Service and inspectors of the Road Transport Inspection are authorized to control the correctness of paying the toll for using motorways, including the control of mobile devices, on-board devices or external location systems using satellite positioning and data transmission technologies.

Police officers may control the correctness of paying the toll for using motorways, including the control of mobile devices, on-board devices, or external location systems, when performing their statutory tasks.

For no payment for using motorways, including for the continuation of travel on a motorway or its section after the expiry date and time of the validity period indicated on the motorway ticket, an additional amount of PLN 500 is charged from the person paying the toll. The request for payment concerning the additional amount is issued by the Head of the National Revenue Administration. If the additional amount is paid within 7 days from the date of delivery of the request for payment, it is reduced by PLN 100 from the amount indicated in the request.

The person paying is charged one additional amount, regardless of the number of travels made on the motorway or its section, with the same vehicle, for one day, understood as the period from 00:00 to 24:00 on a given day.

If it is found during an inspection carried out by officers of the Customs and Tax Service, inspectors of the Road Transport Inspection or Police officers that the person paying the amount:

- has not paid the toll for previous travels on a motorway or its section, an

- resides or is seated in a country with which Poland is not bound by an agreement or resolution on cooperation in the mutual recovery of the amount, or the possibility of debt enforcement does not arise directly from international regulations and the provisions of that country,

the person carrying out the control collects a deposit in the amount of the additional payment for each of the travels.

The additional amount is not charged if the vehicle driver has been fined by a fine for traveling on a toll motorway or its section without a valid motorway ticket or without a properly functioning on-board device, mobile application or external location system ensuring the transmission of geolocation data to the e-TOLL system.

List of bank accounts of the competent tax offices for the payment of the surcharge

Check out list of bank accounts of the competent tax offices for the payment of the surcharge. Read

Specimen of a demand for payment of a surcharge

See what a demand for payment of a surgarge looks like.Read

Objection to the demand for payment of a surcharge

The person paying has the right to raise an objection to the Head of KAS in the event of an additional amount being imposed. The lodging of an objection does not release from the obligation to pay the additional amount.

Proceedings on a filed objection are conducted on the basis of the provisions of the Code of Administrative Procedure, which regulate the mode and manner of proceeding with the case.

The most common mistakes made when filing an objection and during the proceedings:

An objection sent by standard mail has no legal effect. The objection should be submitted via the Polish Post, at the address for electronic delivery or in person;

The objection must be filed within 14 days from the date of service of the summons - this deadline is a substantive deadline - non-transferable.

The filing of an objection does not release from the obligation to pay an additional fee of PLN 500 (or PLN 400 if the payment is carried within 7 days of receipt of the Summons)

The date of filing an objection shall be the date of posting at the post office. The deadline for filing an objection sent by other means than through the Polish Post is met when, at the latest on the last day to file it, it is received by the Authority;

A power of attorney must be submitted with stamp duty when the objection is not submitted by a Party;

Lack of signature on the objection or signature of a person without an attached power of attorney

along with proof of payment of stamp duty on the power of attorney precludes its consideration;

The most common formal deficiencies in the objections filed (causing prolongation of the proceedings) are related to the failure to include in their content:

the name and surname of the person or company from whom the objection originates,

address of the person or company from which the objection originates,

taxpayer identification number (Pesel or NIP),

reasons for filing the objection,the number of the bank account or the account in the cooperative savings and credit union to which we are to return the additional fee paid, if we accept the objection,

lack of signature of the person filing the objection or lack of signature of the authorized (proxy).

If the objection is filed by a person who is not the addressee of the call for payment of the additional fee, it is also a formal deficiency not to attach to the objection a power of attorney, clearly indicating agreement to represent the party in the proceedings.

Failure to complete the above formal deficiencies may result in leaving the objection unprocessed.

FAQ

Check out the answers to the most common questions about the demand for payment of a surcharge. Read

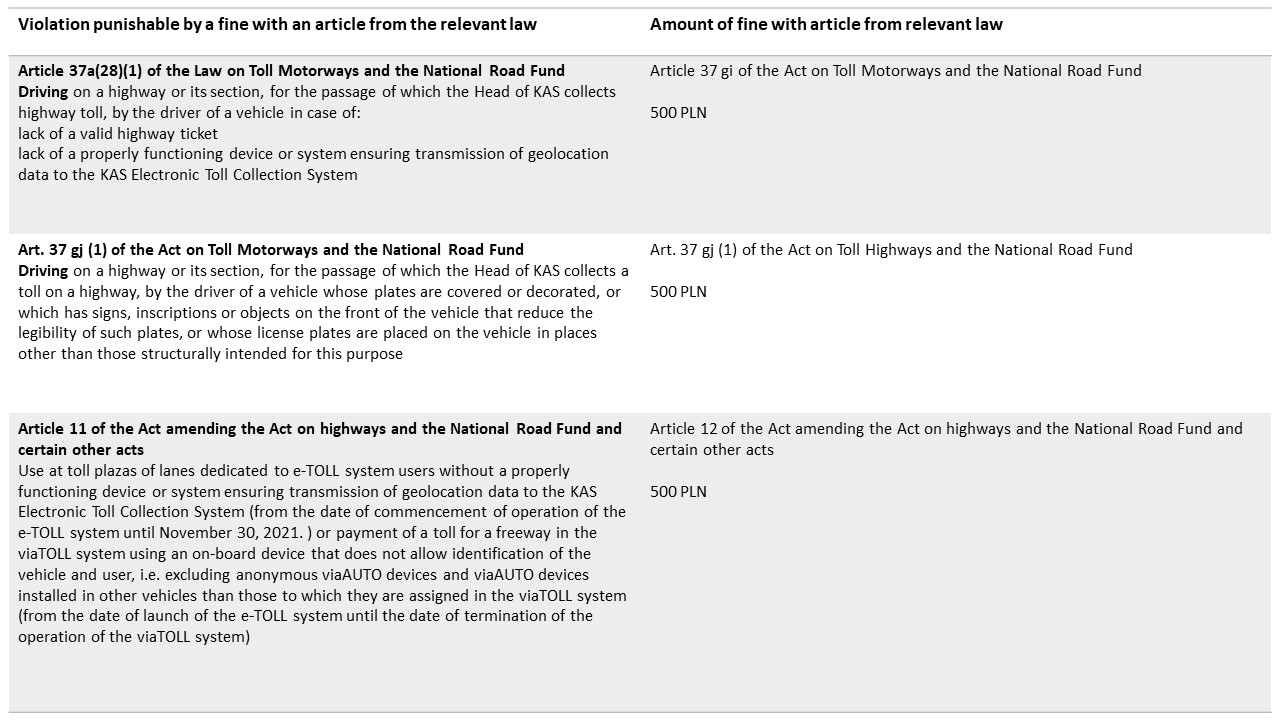

Legal basis